The Webscale Blog

The latest news and opinions surrounding the world of ecommerce

- #all

- #adobe

- #analytics

- #automation

- #cloud-hosting

- #cloud-migration

- #corporate

- #customer-case-study

- #customer-experience

- #cyber-week

- #developers

- #devops

- #edge

- #events

- #feature-brief

- #headless/pwa

- #hosting

- #intelligent-cloudops

- #kubernetes

- #magento-(adobe)

- #managed-ci-cd

- #partners

- #performance

- #reliability

- #replatform

- #security

- #supercloud

- #support

- #uptime

- #vertical-focus

- #why-webscale

How to Solve GraphQL Latency Challenges by Deploying Closer to Your Users

GraphQL is a widely adopted alternative to REST APIs because of the many benefits that it offers, including performance, efficiency, and predictability. While the advantages are significant, many developers become frustrated with latency challenges when implementing...

Popular Posts

Ecommerce Holiday Shopping 2022: What to Expect and How to Prepare?

This year will mark a critical U.S. retail milestone, as ecommerce will cross the $1 trillion mark for the first time, according to the latest retail forecast from Insider Intelligence. We now expect total U.S. retail spending in 2022 to grow by 6.4% year over year to...

The Global Ecommerce Security Report 2022

Cyberattacks continued to rise in 2021 even though ecommerce sales saw a minor dip compared to 2020. According to industry reports, more than half of all cyberattacks on ecommerce websites in 2021 were carried out by bots, including sophisticated bad bots that can...

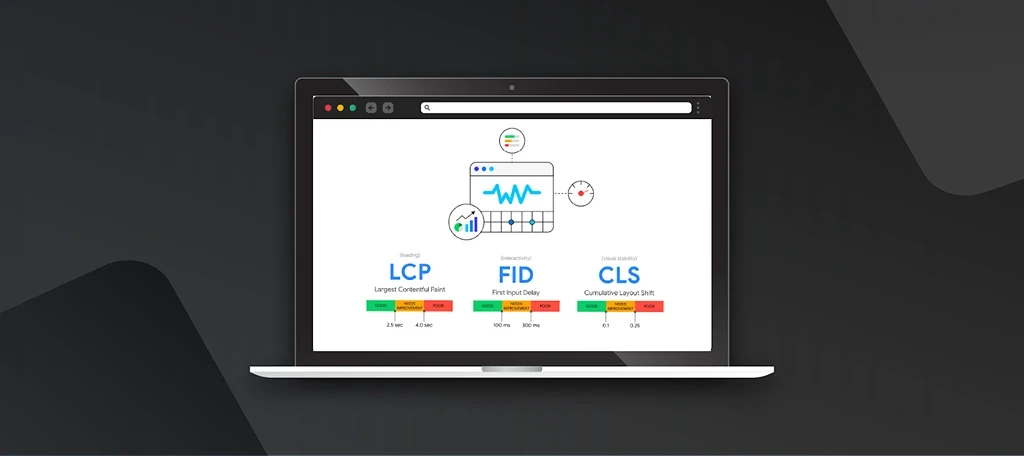

How a CDN can boost your Core Web Vitals

Ecommerce merchants are always looking for ways to improve their site’s performance. Slow website pages can harm businesses as they increase bounce rates and can negatively impact customer satisfaction. Beyond this, poor performance can also impact end-user retention,...

3 Ways to Write Better Caching Modules in Magento

Paul Briscoe is Director of Development at Human Element In today’s marketplace, online merchants are focused on the speed of their website as a key indicator for how they will perform. Outside of actual sales revenue, page speed can be the ultimate measure of success...

5 Ecommerce Security Trends to Watch Out for in 2022

Over the past year, the ecommerce sector has seen a surge in sales. Owing to the pandemic, ecommerce platforms have embraced the digital journey of millions of consumers to drive growth, revenue, and customer engagement. According to a report by UNCTAD, online sales...

Headless Commerce Drives Edge Computing Adoption

In e-commerce today, the challenge to meet and exceed customer expectations is driving innovation. The demand for frictionless shopping, 24/7 availability,...

Two Aspects of Edge Compute to Focus on for Reducing Edge Complexity

As organizations look to capitalize on the benefits of edge computing, many are quickly realizing the complexities associated with building and operating...

Edge Developers Leading the Way on Kubernetes Adoption, But Complex Infrastructure Still a Challenge for Many

A survey released by SlashData™ for the Cloud Native Computing Foundation (CNCF) recently looked at “The State of Cloud Native Development” based on feedback...

The Complexities of Building and Operating Edge Networks and Infrastructure

This is the final post in a three-part series digging into the complexities that developers and operations engineers face when building, managing, and scaling...

The Complexities of Replicating the Cloud Developer Experience at the Edge

Over the last fifteen years or so, developers have become very familiar with cloud deployment. Whether using AWS, Azure, GCP, Digital Ocean, or a more niche...

Leveraging Containers as a Service (CaaS) at the Edge

Container technology derives its name from the shipping industry. As opposed to transporting goods as individual units with various packed sizes, goods are...

What’s the difference between multi-cloud, multi-location cloud and supercloud?

As cloud computing continues to evolve, businesses have access to more options than ever before. Two popular cloud strategies are multi-cloud and...

Webscale CloudFlow: The Answer to cluster fleet management for complex Kubernetes deployments

The landscape of Kubernetes cluster management is brimming with challenges, as recently outlined in Gartner's report on implementing cluster fleet management...

Cloud impact on margins: $100B market cap erosion

For most of us, our experience with the cloud is the monthly bill from Google or Apple. We do not care much because it does not make up even one percent of...

Redefining Distributed Applications with CloudFlow: Dynamic Endpoint Automation, Cloud Cost Control, and Operational Simplicity

“Optimization happens constantly, automatically, and transparently to the operations teams and the end users.” Traditionally we have hosted applications in...

Getting a Grip on Multi-Cloud Kubernetes

Cloud computing industry expert and author David Linthicum recently wrote in InfoWorld how he believes 2023 may finally be the year of multi-cloud Kubernetes....

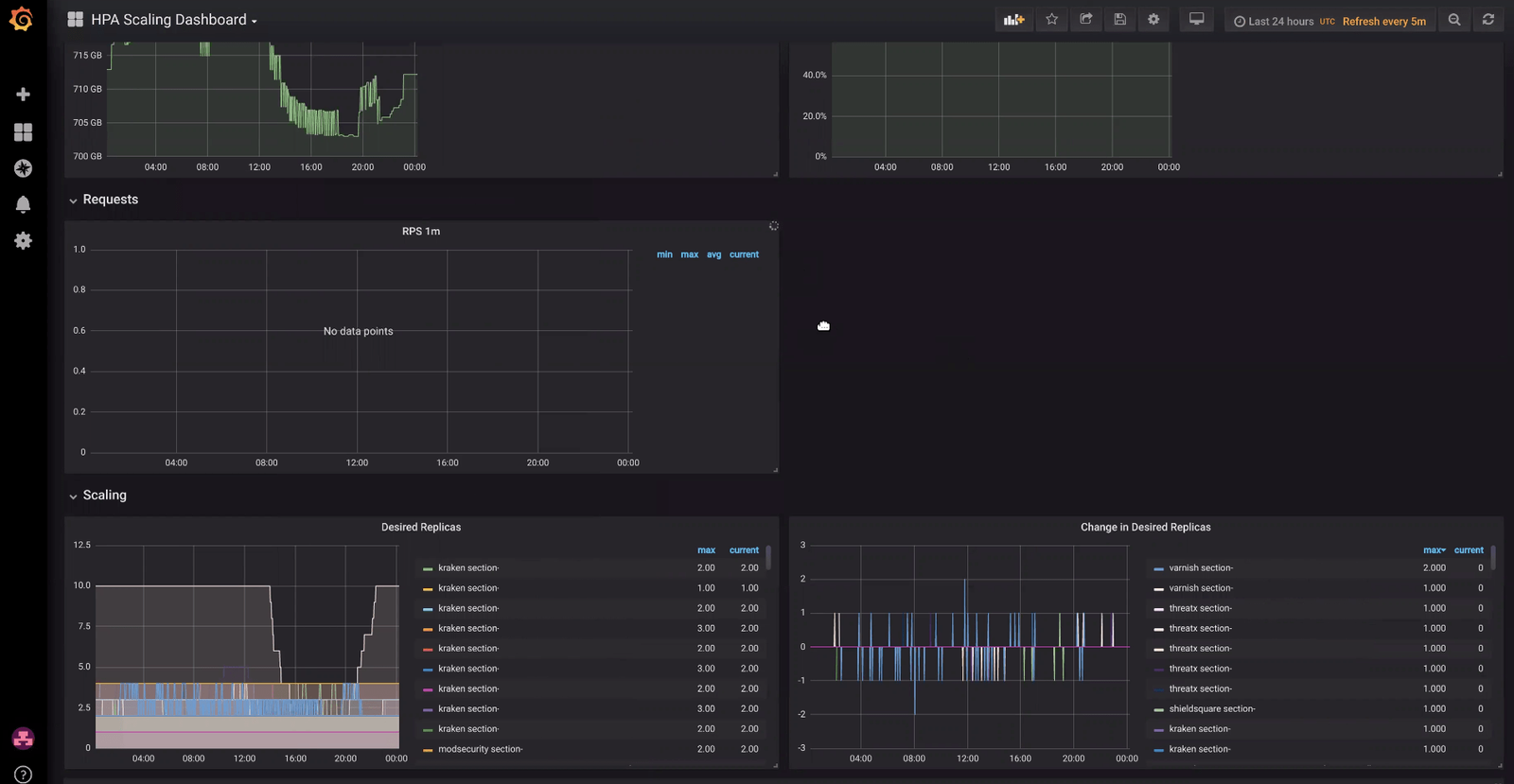

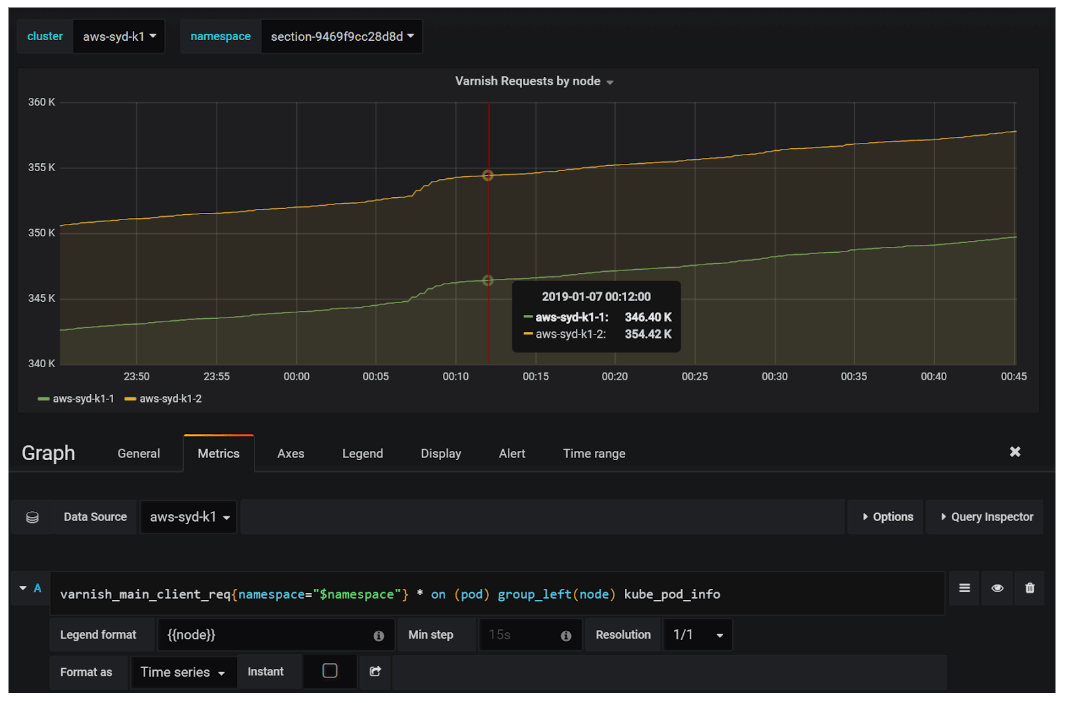

Using the Kubernetes Horizontal Pod Autoscaler with Prometheus’ Custom Metrics

With Kubernetes as the backbone of the CloudFlow Platform, we manage a large, complex network of globally distributed clusters with the goal of optimizing...

Supercharging LLMs with Supercloud

Supercloud, characterized by a decentralized and distributed architecture, has the potential to revolutionize cloud computing. This paradigm shift could have...

Simplifying Managed Multi-Cloud and Edge Kubernetes with Helm Charts

One of the central observations we made in our recent blog post about Edge Computing Challenges for Developers was the need for familiar tooling, noting that...

Roadmap to the Adaptive Edge – Balancing Cost Efficiency, Usability, and Performance Tradeoffs

The network edge presents new challenges in optimizing application deployments, as the deeper an application is pushed into the internet, the greater the...

The Seven Benefits of Distributed Multi-Cluster Deployment (Part 2)

Last week we published Part 1 of a two-part series on the benefits of distributed multi-cluster deployments for modern application workloads, based on our...

The Seven Benefits of Distributed Multi-Cluster Deployment (Part 1)

With the release of Webscale CloudFlow’s patented Kubernetes Edge Interface (KEI), it’s important to step back and look at why organizations need a solution...

Key Kubernetes and Edge Trends to Watch

Daniel Bartholomew, Webscale's Chief Product Officer, has shared his insights on four noteworthy trends to monitor within the realms of Kubernetes, container...

How Edge Compute is Enabling Better and More Affordable Gaming Experiences

A couple months back, we published an article talking about game developers looking to the edge and the transformative value it can offer, particularly in...

5 Must-Haves in an Edge as a Service (EaaS) Solution

The “as a service” model is relied on heavily by companies today to meet a wide range of needs. Software as a Service (SaaS) may be the most recognizable of...

Prometheus Querying – Breaking Down PromQL

Prometheus has its own language specifically dedicated to queries called PromQL. It is a powerful functional expression language, which lets you filter with...

Three Edge Computing Challenges for Developers

Organizations are seeking to migrate more application logic to the edge for performance, security and cost-efficiency improvements. Edge migration poses...

Building for the Inevitable Next Cloud Outage – Part 2

This is the second post in a two part series based on a talk by Pavel Nikolov of Section (acquired by Webscale in 2023) at the recent Europe 2022...

Building for the Inevitable Next Cloud Outage – Part 1

The following is based on a talk by Pavel Nikolov of Section (acquired by Webscale in 2023) at the KubeCon+CloudNativeCon Europe 2022 event. This first post...

Deploy Apps to the Edge as Easily as to a Single Cluster with CloudFlow’s New Kubernetes Edge Interface

The pandemic has kicked digital transformation into overdrive: businesses have shifted more user engagement to application workloads, while users expect more...

Scaling Horizontally vs. Scaling Vertically

Capacity planning is a challenge that every engineering team faces when it comes to ensuring the right resources are in place to handle expected (and...

How to Solve the Edge Puzzle

Finding the right technology solutions these days can feel like trying to hit a moving target. With web applications both increasing in complexity and...

Understanding Your Edge with CloudFlow’s Next-Gen Observability Tooling

Edge computing is complex. We can attest to this, having built an edge compute platform from the ground up. One of the fundamental challenges that we’ve faced...

Kubernetes Is Paving the Path for Edge Computing Adoption

Since Kubernetes’ release by Google in 2014, it has become the standard for container orchestration in the cloud and data center. Its popularity with...

Intelligent CloudOps blog series Part 3: How Intelligent CloudOps turns TCO into ROI

For ecommerce, an Intelligent CloudOps strategy connects application and infrastructure performance to checkout conversions, which enables organizations to...

Multi-cloud, Multi-location and Supercloud Strategies Explained

In the ever-evolving landscape of cloud computing, businesses are faced with a myriad of choices, each presenting unique advantages and complexities. Among...

Why is Observability Important in Ecommerce?

Before we apply elements of implementing observability measures for ecommerce businesses, we need to understand what general observability is. What is...

Intelligent CloudOps blog series Part 2: Data Path Observability for Ecommerce – and How it Could Increase Sales

You can’t fix what you don’t see Data path observability is the ability to see and understand the data flow from the originating request source, to the...

Intelligent CloudOps blog series Part 1: Why is an Intelligent CloudOps strategy crucial for ecommerce success?

In ecommerce, Managed Hosting is a building block, not a solution With U.S. ecommerce sales in 2022 exceeding $1 trillion, it is safe to say that ecommerce is...

Empowering Application Developers: The Era of Distributed Compute

In the realm of traditional cloud deployments, developers often found themselves restricted, unable to fully influence the application’s delivery and user...

Should you consider FEaaS solutions for your Headless build?

In the rapidly evolving world of ecommerce, businesses are constantly seeking ways to provide seamless and engaging online shopping experiences. As the demand...

Decoding the Supercloud

In our increasingly digitized world, the demand for robust cloud computing solutions has reached new heights. Modern enterprises seek cloud infrastructure...

Can Going Headless Enhance Your Site’s Core Web Vitals Score?

In the ever-evolving world of ecommerce, businesses are continuously striving to provide exceptional online shopping experiences to their customers. One...

Cache Warming – Optimizing User Experience

Cache warming is a concept which is used to optimize the performance of a website or web application by preloading the cache with frequently accessed content....

Webscale is an Adobe Accelerate Partner – what that means for merchants.

If you’re reading this, Webscale is officially an Adobe Exchange Partner at the Accelerate level. Of course, this is big news for Webscale but arguably bigger...

5 Ways to Secure Your Headless Commerce Storefront

As headless commerce gains popularity for its flexibility and scalability, it also introduces new security challenges for businesses. In a headless...

Is Going Headless the Right Path for Your Ecommerce Business?

In the fast-paced world of ecommerce, staying ahead of the competition and delivering seamless user experiences are paramount. As businesses seek innovative...

Enabling Merchants and Marketplaces in the Cannabis Industry

In 2021, legal cannabis sales (medical and adult-use) across 39 states and the District of Columbia ($24.5 to $27 billion) overshadowed Starbucks ($20.5...

Ecommerce Holiday Shopping 2022: What to Expect and How to Prepare?

This year will mark a critical U.S. retail milestone, as ecommerce will cross the $1 trillion mark for the first time, according to the latest retail forecast...

Part 2: Trying Out Headless WordPress: Gatsby

Webscale is a big supporter of going headless, taking your monolithic server application like Magento or WordPress offline and using it to generate a static...

Part 1: Trying Out Headless WordPress: WP2Static

Webscale is a big supporter of going headless, turning your monolithic server application like Magento or WordPress into a data source for a “simpler”...

Is Your Ecommerce Store Ready for Cyber Week 2022?

Everyone has a view on what this year’s Black Friday/Cyber Monday will look like. Though more and more consumers have shopped early in the past few years due...

Online Brand Store or Online Marketplace or Both? How Can Cannabis Merchants Decide?

Many cannabis brands joined the ecommerce bandwagon during the pandemic to ensure their offerings were accessible to customers and patients. The biggest...

The art of loading your Magento store in under 3 seconds

Andrew Bouchard is the Head of Business Development at Ziffity Solutions LLC. Magento is a fully-loaded platform that offers all the essential and advanced...

Dockerized Magento 2.4.4 in 4 Steps

We’ll be providing handy tips, tricks, and integrations for Magento now and then in this blog and it’s nice to have a clean, no-risk local environment where...

Embracing the MACH Approach for a Successful Headless Build

Ecommerce businesses are continuously seeking ways to stay ahead of the competition, by providing seamless customer experiences, and adapting to changing...

Webscale Earns SOC 2 Type 2

Webscale has earned SOC 2 Type 2 compliance certification. That's actually a big deal. In simple terms it means a rigorous and respected third party audit has...

Headless Made Easy With Webscale CloudEDGE PWA and Vue Storefront

Webscale is partnering with Vue Storefront to add their solution for composable, headless content and commerce experiences to our pre-configured and tested...

The Global Ecommerce Security Report 2022

Cyberattacks continued to rise in 2021 even though ecommerce sales saw a minor dip compared to 2020. According to industry reports, more than half of all...

Deliver Engaging Buying Experiences on Any Device With Headless Commerce

Andreas Knoor is the Chief Product Officer of Crownpeak. This blog first appeared on the Crownpeak website. In September 2021, Crownpeak announced a strategic...

10 Cybersecurity Features Ecommerce Merchants Shouldn’t Ignore in 2022

According to industry reports, more than half of all cyberattacks on ecommerce websites in 2021 were carried out by bots, including sophisticated bad bots...

Troubleshooting Your Web App Slowdown in 7 Steps

In this article, I will walk you through the step-by-step process of diagnosing an increase in the average time to first byte (TTFB) for an application...

How to De-Risk Cloud Region Selection

When building a cloud application, one of the first decisions to consider is where to deploy it. In fact, Google’s helpful document on Best Practices for...

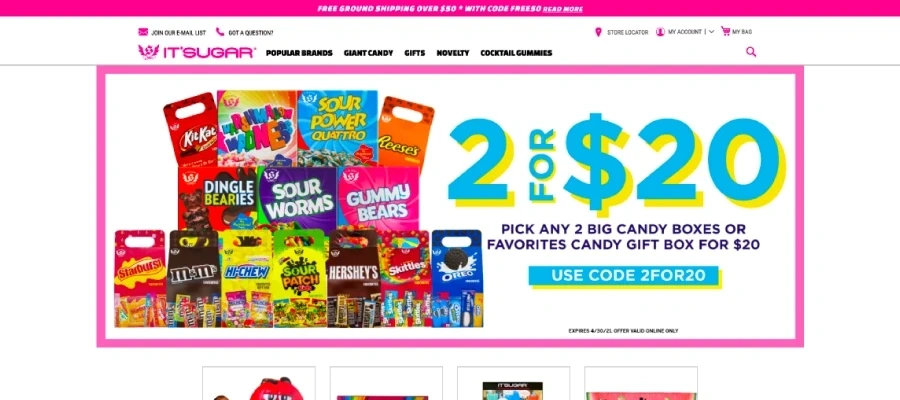

IT’Sugar is Sweet on Webscale’s Expertise

“They’re quite helpful,” declared Steve Parris, Vice President of IT for IT’Sugar, a national confectionery retailer, when asked about Webscale. “They really...

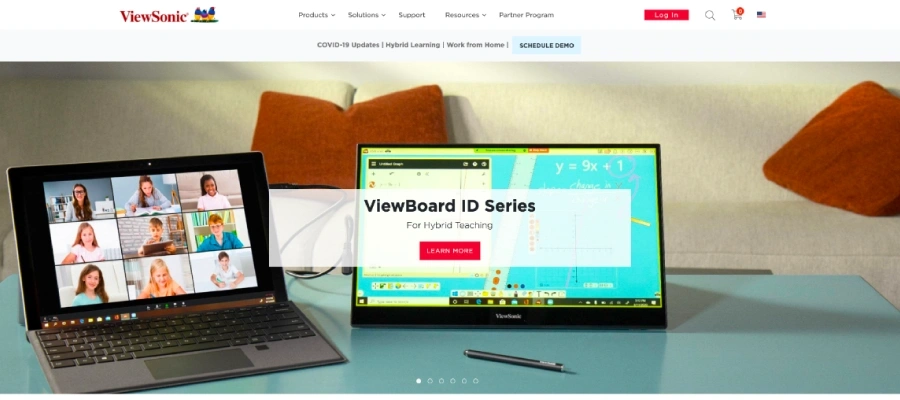

Support, Cloud Gave Viewsonic Reasons to Move

Since 2012, ViewSonic has hosted its ecommerce solution on Magento, now owned by Adobe. Viewsonic is a leading provider of monitors, displays, and projection...

The Secrets of Magento Auto-scaling

One of the biggest reasons Magento stores prefer cloud-based hosting is the idea that the store can easily scale up during periods of heavy traffic, such as...

Optimizing Magento 2 for Speed

It’s no secret that speed counts in today’s Internet. Google has made it quite clear that the faster web pages render, the better it is for a website’s...

How a CDN can boost your Core Web Vitals

Ecommerce merchants are always looking for ways to improve their site’s performance. Slow website pages can harm businesses as they increase bounce rates and...

3 Ways to Write Better Caching Modules in Magento

Paul Briscoe is Director of Development at Human Element In today’s marketplace, online merchants are focused on the speed of their website as a key indicator...

Webscale CloudFlow Simplifies Global SaaSification

For software companies, offering their software as a SaaS solution versus an on prem or cloud only model means; Shorter customer deployment times which...

Key Takeaways From 2021 Cyber Week

This year, consumers began their holiday shopping early, as early as October in some cases, concerned about the supply chain-related challenges that are...

5 Ecommerce Security Trends to Watch Out for in 2022

Over the past year, the ecommerce sector has seen a surge in sales. Owing to the pandemic, ecommerce platforms have embraced the digital journey of millions...

Top Considerations for Containers at the Edge

Some things are just made to go together, like containers and edge computing. Containers package an application such that the software and its dependencies...

Top 3 ecommerce frauds and how to tackle them

Tyler Mullen is director of marketing at Kensium. Amazon founder Jeff Bezos once said: “We see our customers as invited guests to a party, and we are the...

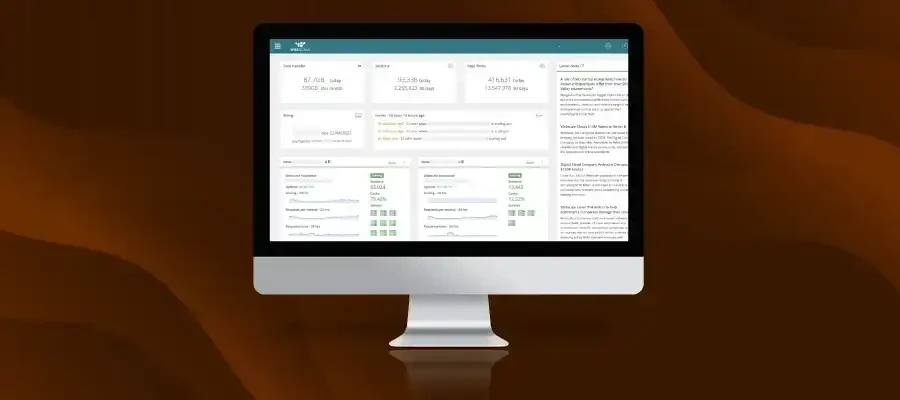

Monitoring your sales funnel and site operations with Webscale

Every time a shopper accesses your site, they leave a trail of breadcrumbs detailing their path through your store and their user experience along the way....

Taming Core Web Vitals in Time for the Holidays

This article was originally published on the Magento Association website as a Commerce Co-op blog on October 20, 2021. For more than a decade, Google has...

The Webscale Portal – an Ecommerce Merchant’s Super-power!

Ecommerce sales worldwide touched $4.28 trillion in 2020 and are projected to grow to $5.4 trillion by 2022. With the upcoming holiday shopping season set to...

Predicting Your Hosting Cost Per Order

Do you know what your hosting is costing you for each sale? When planning for hosting, merchants and developers are often left with a conundrum: how much...

2021 Global Headless Report

Consumers have become disloyal, so delivering a great user experience is key to securing their continued attention. As a result, the world of modern commerce...

Edge Security for Modern Commerce

David Baier, Managing Partner, of leading digital agency Crimson Agility recently joined me for a podcast to discuss security at the edge and technology...

The 3 Pillars of Ecommerce Customer Experience

Graham Van Der Linde is Head of Brand and Creative at Eclipse UK For years we’ve been told that picking the right platform to build our website on was the...

Your Entire Business Needs RUM, Not Just Developers

Real User Monitoring (RUM) is a passive monitoring methodology that captures all end user interactions with a website or application. While RUM has been...

Magento Security at the Edge: Cyber Crime’s Next Hunting Ground

At the recent Magento Association (MA) Connect 2021 event, Webscale’s Head of Strategic Partnerships, Adrian Luna, presented a session on Magento Security at...

Why the Right Time to Move to the Cloud is NOW!

Without a doubt, 2020 will likely be remembered for so many reasons that they could end up rivalling the length of your average CVS receipt. It was the year...

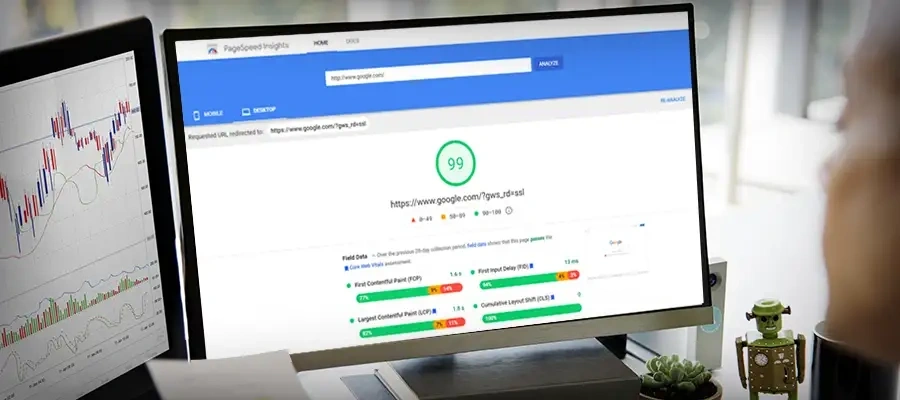

Webscale’s Top 4 Proven Strategies for Great Core Web Vitals

Speed optimization and page performance are critical for driving a seamless customer experience, and the ability to accurately measure these elements is...

Beyond Traditional Ecommerce Hosting & Security

Webscale’s Head of Strategic Partnerships, Adrian Luna, recently got chatting with Frank Thomson, VP of Marketing and Sales at leading ecommerce agency...

Magento 1 PCI-compliance Rears Its Ugly Head…Again PayPal Joins in…Again

Hard to believe it’s been almost a year since M1 went EOL. I don’t think last year qualifies for the statement of “time flies when you’re having fun”, but...

Embrace Modern Commerce Today, for a Brighter Tomorrow

Encompassing a far broader range of touchpoints and interactions throughout the entire consumer journey than ever before, the era of modern commerce seeks to...

Get Ahead of Core Web Vitals with (Webscale) Real User Monitoring

Last year, Google announced that the user experience signal fed into its search ranking algorithm is undergoing an update, initially for mobile and, shortly...

Site Safety in the Road Warrior World of the Pandemic

During the last year of the pandemic, many people have been working remotely, or on the road. In well managed environments this creates some support issues,...

Magento Security – 7 Steps to Lock Down Your Ecommerce Site

Charles Martey is the Systems Integration Director at Above The Fray. Cybercrimes are on the rise and like all ecommerce platforms, Magento websites are a...

The pulse of application health: TTFB!

In conventional medicine, your pulse can help reveal a lot of underlying problems. In the same way, if there is a single metric that is measured and tracked...

Do you need a PWA? Myths and Reality

Yaroslav Rogoza is the Chief Technical Officer of Atwix and one of its first employees. Over the past few years, PWA and headless have proven to be some of...

Webscale Secures $26M in Funding to Fuel Ecommerce Cloud and Growth

Webscale recently announced the closing of $26 million in growth capital financing from investors and Silicon Valley Bank. The Series C round was led by BGV,...

Preparing for Ecommerce Success in 2021

Leading digital agency in the UK, Eclipse recently joined us for a webinar to discuss ecommerce success strategies for 2021. From Eclipse, Tim Stainthorpe,...

PWA Explained: What to Expect in 2021

Brent Peterson is President and Co-founder of Wagento Commerce. Although Progressive Web Apps (PWAs) were first introduced by Google back in 2015 as a...

The 2021 Global Ecommerce Security Report

In 2020, as the global ecommerce industry witnessed a decade’s worth of growth in a matter of months, so did the threat of cyber attack on those same...

Webscale Technology Wins New Industry Awards

2020 was a rollercoaster year to say the very least. Yet, with enormous challenges come opportunity and fortunately for Webscale, with its laser focus on the...

Is Edge as a Service (EaaS) the Next Big Thing in Tech?

Software as a Service (SaaS) was the largest market segment in the cloud in 2020 and Gartner forecasts it to grow to $117.7 billion by the end of this year....

Corra and Webscale Get Technical on PWA

Luigi Iuliano, CTO at Corra, and Jay Smith, Founder and CTO at Webscale, recently caught up for a livestream to discuss the hot topic of Progressive Web Apps...

JAMstack done right

Increasingly, ecommerce market leaders are focusing on enriching user experiences across a wide variety of buyer endpoints such as voice-enabled shopping...

Key Takeaways from 2020 Cyber Week

Despite a challenging year, the 2020 Cyber Week broke records with consumers spending $9.03 billion on Black Friday, and $10.8 billion on Cyber Monday. While...

The Challenges of Distributed Databases at the Edge

Global Internet traffic in 2021 will be equivalent to 135x the volume of the entire Global Internet in 2005, according to Cisco. Globally, Internet traffic...

What is Site Splice?

Today’s modern web applications have many components - shopping carts, blog posts, product lists, user reviews, and more. The traditional method of hosting...

Improve your Application’s Performance with Dynamic Site Cache

One of the best ways to improve the performance of a web application is to enable caching. The most commonly used caching method stores copies of static files...

Why Hosting Providers Have the Inside Track on the Best Developers

The quality, and related success, of your online presence can all hinge on the agency or system integrator (SI) you choose to work with. However, the search...

Without Observability, DevOps is Doomed

Speed of innovation is a key differentiator for businesses in a competitive market. Developers working at the bleeding edge of technology are always looking...

Part 2: The Cost Implications of Moving to a Progressive Web App

The following conversation took place on the eCommerce-Aholic channel, between the show’s host TJ Gamble, CEO of Jamersan, and Jay Smith, Founder and CTO of...

Is Your Storefront Battle-Ready for Black Friday 2020?

Everyone has an opinion on what this year’s Black Friday/Cyber Monday will look like. We shared a blog back in August that looked at what some of the biggest...

The Largest M1 Breach to Date – What You Need to Know

Last weekend, there was a Magento 1 security breach that impacted more than 2000 storefronts, and that number could be higher. The attack used the "Magento...

Part 1: The Challenges of Hosting a Magento Progressive Web App

The following conversation took place on the eCommerce-Aholic channel, between the show’s host TJ Gamble, CEO of Jamersan, and Jay Smith, Founder and CTO of...

What is the Webscale Control Plane?

If the Webscale Data Plane is the heart of your application then the Webscale Control Plane is the brain. Webscale’s distributed control plane is decoupled...

What is the Webscale Data Plane?

Welcome to Tech Corner! In this new section of the blog, we’ll be sharing some of our more technical content, including explainer blogs on some of the...

3 Reasons You Need to Move Off Rackspace, Today

When it comes to choosing a hosting provider for your ecommerce storefront, Rackspace is about as far from being the right choice as possible. There, we said...

Black Friday 2020 – What Should Merchants Expect?

Walmart, Target, Best Buy and Kohls are among the first to make the big announcements that they will not be opening stores on Black Friday due to the COVID-19...

Creating the Mutual Funds of Edge Computing

At Section, we are working to leverage data science and machine learning methods to create the mutual funds of edge computing. In finance, Modern Portfolio...

Securing a Distributed Edge Network

Security for edge computing is ipso facto a large and complicated topic. In our previous post, we looked at challenges specific to security at the edge. In...

Why Going Headless Doesn’t Have to Mean Losing Your Head

I’ll confess to saying that whenever I hear the term “headless ecommerce”, I think of Nearly Headless Nick. But it turns out that headless ecommerce has...

Magento 1 EOL: What Visa and PayPal Said and What You Need to Know

Last Updated On: August 3, 2021 UPDATE: 2021 is a new year, but it’s the same story - Paypal has sent new communications to merchants on Magento 1 (M1)...

Comparing OpEx vs. CapEx Models at the Edge

When Akamai was founded in 1998, co-founders Daniel M. Lewin and Tom Leighton, were not only inventing the first content delivery network (CDN), but...

COVID-19 Has Transformed Ecommerce in These Five Surprising Markets

Last Updated On: August 3, 2021 Human beings are a resilient lot. We have an innate ability to weather a storm, and find ways to not only survive, but thrive....

Magento 1 EOL Support – You Have Options, Pick the Right One

Last Updated On: August 3, 2021 UPDATE: Fast forward to today - it’s now been over a year since Magento 1 (M1) went end of life (EOL). PCI compliance requires...

6 Top E-Commerce Developers Share Recommendations on Tackling Magento 1 End of Life

With Magento 1’s end-of-life (EOL) less than 60 days away, the race is on for merchants still on M1 to find a way to stay there, re-platform to M2, or migrate...

9 Top Ecommerce Developers Comment on Magento 1 EOL Preparedness and Concerns

With Magento 1’s end-of-life (EOL) coming up in less than three months, a lot of ecommerce merchants seem both confused and concerned. And rightly so, given...

The State of Ecommerce Infrastructure 2019

The Cyber Weekend of last year was the biggest one ever in U.S. ecommerce history, with online shopping spend increasing to more than $9.4 billion on Cyber...

How Online Retailers Fared in Performance & Security During Holiday 2019

This article was originally published in Digital Commerce 360 on Feb 17, 2020. The Cyber Weekend in 2019 was, undoubtedly, the biggest one ever in U.S....

7 Top Developers Share 2020 Predictions for E-Commerce

The last decade has been a spectacular one for e-commerce. Global e-commerce revenues grew more than 500% between 2010 and 2019. Amazon continues to have the...

Magento 1 Merchants: June 2020 Is NOT the End. We’ve Got Your Back!

With Magento 1’s end-of-life coming up, it might seem like everyone is scrambling for cover. And understandably so, given the fact that after June 2020,...

[CASE STUDY] HOW EVENT NETWORK’S 100+ ONLINE STORES STAY UP AND SECURE THROUGH THE HOLIDAY SEASON AND BEYOND, WITH WEBSCALE

In 1998, Event Network launched a store for the Titanic Artifact Exhibition in Boston. Today, the company is a leading operator of experiential retail stores...

6 Top E-Commerce Developers Share Black Friday Success Tips for Online Merchants

Black Friday and Cyber Weekend are upon us! According to projections from Digital Commerce 360 (formerly Internet Retailer), U.S. shoppers are set to spend a...

Are you ready for Magento 2.2 End of Life?

Magento 2.2 is the new Magento 1! Come December 31, 2019, Magento 2.2.x will end of life (EOL) and thousands of merchants will likely be stuck without access...

Are You Re-platforming for the Wrong Reasons?

The decision to re-platform, from one e-commerce platform to another, is never easy, fast, or cheap. In this blog, we’ll share our experiences from...

Holiday Season 2019: What Online Merchants are Expecting…

If you’re in the e-commerce business, you already know that the time to start preparing your online storefront for the upcoming holidays was yesterday! With...

[Case Study] How Skate One Skated to Site Uptime, Performance, and Support Wins with Webscale

Since 1976, Skate One has manufactured and distributed high-performance skateboard decks, wheels, bearings, trucks, hardware, clothing, and accessories. They...

[Case Study] How Skinit Achieved 100% Uptime and Blazing Fast Performance with Webscale

Skinit is the global leader in personalized and branded products for electronic devices. The company creates high quality cases and skins to protect...

[Case Study] How Dolls Kill Sustains 100% Uptime, Blazing Fast Performance, and Hyper-Growth with Webscale

Dolls Kill, a leading global online fashion retailer, celebrates a rebellious spirit and attitude, mixed with a bit of punk rock, goth, glam, and festival...

[Case Study] How HYLETE went from a Black Box to the World`s Most Scalable Hosting Infrastructure

HYLETE is a direct-to-consumer brand that creates premium performance athletic apparel – built for the modern athlete and priced for everyday use. What...

The 4 T Framework for Re-platforming Success

June 2020 - for many online merchants and Magento developers, it's a date that's already burned into memory. Magento 1 will end of life and with that, no...

How to Shield Your Online Storefront from Cyberthreats with Webscale’s Web Controls

Since the advent of digital commerce, hackers have kept both online merchants and the cybersecurity industry on their toes. Large security breaches occur...

What Are GA Sessions?

And how are they used to calculate billing? As a Webscale Stratus customer, you know that your monthly billing is a calculation of Plan Rate plus any overage...

How’s your Cloud Journey?

Despite its arrival over a decade ago, many digital commerce businesses continue to struggle with finding success in the cloud. Organizations often set...

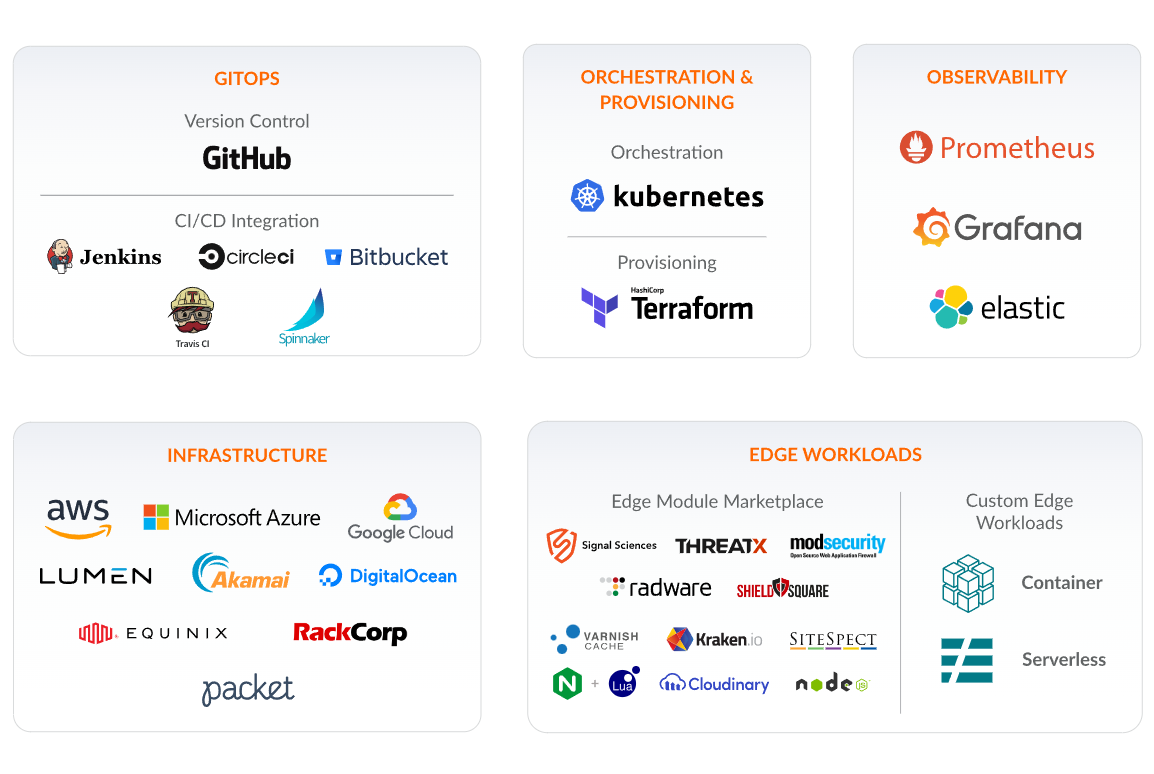

CloudFlow Technology Stack – Empowering DevOps Teams with Flexibility and Control at the Edge

Here’s a breakdown of the CloudFlow technology stack used by (or integrating with) Webscale. DevOps teams enjoy the flexibility and control that the CloudFlow...

3 Reasons Integrated Platforms are Better than Point Solutions for your Applications and Business

On June 4, 2019, we saw the news about Distil networks, a point solutions company offering bot management, being acquired by Imperva, a security platform....

Part 3: Actively Managing your Global Cloud Infrastructure: Webscale CEO in Conversation with Cuppa Commerce

This is a three-part blog series. This part discusses the reliability of cloud-based hosting, scalability, the need for outsourcing, tips for cloud migration,...

Part 2: Actively Managing your Global Cloud Infrastructure: Webscale CEO in Conversation with Cuppa Commerce

This is a three-part blog series. This part covers why retailers and commerce brands embrace the cloud, the reality of cloud hosting providers, and why...

Part 1: Actively Managing your Global Cloud Infrastructure: Webscale CEO in Conversation with Cuppa Commerce

This is a three-part blog series. In Part 1, we introduce Webscale, how we work with hyperscale cloud providers, and discuss the challenges commerce brands...

6 Ways To Get Better Visibility and Control of your Website Infrastructure with the Webscale Portal

15 years ago, a typical website’s infrastructure looked pretty simple. But a lot has changed, and hosting architectures today are continuing to increase in...

The E-Commerce Site Owner’s “A-ha!” Moment

It’s a look I see all the time. The “so… you guys are just another hosting provider?” look. However, it’s a look that I enjoy watching fade away once I...

Democratizing the Cloud: Leveling the Playing Field for Digital Businesses

Last week, we announced our Series B round of funding at $14 million. We’ve come a long way as a team, we’ve learned a lot, and it’s a good time to take stock...

8-Point Checklist for Successfully Migrating and Managing Your E-Commerce Site in the Cloud

The time to move to the cloud was yesterday! Tired of being shackled by the physical infrastructure-defined limitations of dedicated hosting environments...

Can you Win the E-Commerce Game of Thrones?

With the eighth and final season of Game of Thrones set to premiere on Sunday, true fans can’t help but get a bit swept up in it all. As the fight for the...

Image Management: What it is and Why it’s Important for E-Commerce

Last Updated On: August 3, 2021 A picture is worth a thousand words. Over 70% of search engine users regularly search for images of products before buying...

Common E-Commerce Infrastructure Challenges and How to Address Them

This article was originally published in TotalRetail on March 21, 2019. According to Webscale’s recent State of E-Commerce Infrastructure report, 6.4 percent...

The State of E-Commerce Infrastructure

The holiday shopping season last year broke all records in terms of e-commerce revenues. Yet, online stores remained plagued with performance, availability,...

The Online Merchant’s Guide to Auto-Scaling

Picture this. You’ve spent weeks preparing for a massive online sale. Your products are priced right. Your social media influencers are primed and ready to...

Top 8 Reasons Why E-Commerce Sites Crash

Back in 2013, Amazon.com lost $66,240 per minute when it crashed. That was six years ago! Today, it’s a well-known fact that you can lose hundreds of...

Where to Find Webscale in 2019

One of the most enjoyable parts of my job is talking live to merchants, and hearing about their challenges first hand. We learn a lot in the process, often...

The state of e-commerce infrastructure: Lessons learned from the 2018 holiday shopping season

This article was originally published in Internet Retailer on Feb 7, 2019. Consumers spend billions of dollars online between October 1 and December 31,...

Demand More from Your Hosting Provider!

Despite the arrival of the cloud over a decade ago, e-commerce infrastructure (especially in the mid-market) continues to struggle with the physical hardware...

What We Learned from The Holiday Shopping Season in 2018

The holiday shopping season of 2018 set new sales records globally for the e-commerce industry. Cyber Monday in the US alone generated close to $7.9 billion...

E-Commerce in 2019: Top 10 Trends for Online Merchants

The e-commerce space is continuing its relentless growth. It is a segment that has made such irrevocable change to consumer buying habits that it is hard to...

Fundamental Technology Challenges for E-Commerce – And How We’re Solving Them

While a lot of merchants saw solid growth this year, the all-too-familiar downtime, performance, and bot/cyber-threat challenges continued to plague many....

WHILE 2018 WAS BIG, IT’S GOT NOTHING ON 2019!

A lot has been going on in the e-commerce industry over the last six months. We’re in the middle of an exciting Holiday Season, the largest ever in terms of...

Why Manage Bots? Here’s Five Reasons.

According to Internet Retailer magazine, Thanksgiving weekend was the largest online shopping weekend ever. Saturday and Sunday, Nov. 24-25, generated $6.4...

8 Reasons Webscale’s Support Team Delights Customers

“Webscale’s support team has been fantastic and often we are notified by Webscale staff about a problem before we have even become aware there is an issue.”...

The Online Merchant’s Guide to Securing Magento Storefronts

Magento recently confirmed that their e-commerce platform suffered a massive malware attack that impacted about 5,000 Magento Open Source users. According to...

Bots – The Good, The Bad, and The Malicious

When Google CEO Sundar Pichai demonstrated the company’s AI-powered Google Assistant’s capabilities earlier this year, we all watched in awe as a highly...

4 New Ways Webscale Has Your Back This Holiday Season

Looking for 100% uptime during the upcoming Holiday Season? For three years in a row, Webscale’s customers have experienced flawless Black Fridays and Cyber...

7 Questions You Should Ask Dedicated Hosting Providers

Running an e-commerce store can be hard. Most business owners are extremely well-acquainted with the dynamics of the markets in which they operate – they are...

Hackers are Smart. How to Be Smarter?

It was May 21, 2014. E-commerce juggernaut eBay shocked the world by announcing that a database containing users' encrypted passwords and other personal data...

CDN Costs Going Through the Roof? Seven Ways to Reduce Them.

According to an article in Forbes, 47% of users expect a website to load within 2 seconds. 40% of users will leave a website if it doesn’t load within 3...

10 QUESTIONS FOR SHOP.ORG 2018

Shop.org 2018, Las Vegas, is the place to be if you are part of the e-commerce industry. At the event, retailers and e-commerce businesses can learn how to...

‘Tis the Season to be Hacking – Is Your E-commerce Store Ready for Black Friday?

Massive global events like Black Friday and Cyber Monday trigger pure online shopping mayhem. According to Forbes, online sales during Black Friday and Cyber...

Why Game Developers Are Looking to the Edge

As we look ahead to the future of edge computing, there are many use cases that are driving demand. However, one area that we are especially interested in is...

A RARE BREAK FROM THE TAX MAN?

Some last-minute tax filers got a break last week, courtesy of the IRS website. Despite the tax filing date being extended two days, the IRS had to extend the...

YOUR CALL IS IMPORTANT TO US

“Your call is important to us. Please hold” If I had a penny for every time I’ve heard those words during a phone call to a service provider (mobile operator,...

Webscale Gets Real

I’m excited to announce our new partnership with value added distributor, REAL security, covering Southeast Europe. When we first met with them, it was clear...

People Break Stuff!

Now we are into the New Year, I’ve had some time to reflect on 2017 and our customers’ experiences, especially on Black Friday, Cyber Monday and through the...

The Webscale Top 10 for Black Friday

Webscale has a 100% uptime record for 2016 across our entire customer base. In an effort to support our customers through another amazing season for 2017, we...

A Tale of Two Black Fridays

Event Network knew something was up when they noticed an increase in DDoS attacks in June 2015. In the run up to Black Friday, that same year, they...

Got WAF?

Cyber attacks increased 22% over Black Friday weekend in 2016. Phishing links are also expected to go up as much as 336% around Thanksgiving, making consumers...

Web Only, Cloud FIrst

This blog originally appeared on the website of Benhamou Global Ventures, one of Webscale's key investors. We have a saying at Webscale – “Deliver, no matter...

Down shouldn’t mean out

Amazon Web Services (AWS) experienced its worst outage in history last week, going down for four hours, and crippling nearly 150,000 websites. The cause –...

The Cloud’s Next Big Disruption – The Application Delivery Controller

This blog originally appeared on the website of Benhamou Global Ventures, one of Webscale's key investors. In part II of a three part blog on cloud computing...

Multi-Cloud is the New Cloud in 2017

Convergence in the cloud brings together advancements not just in compute, storage and networks, but in software and services that together serve the broader...

Eight Reasons I Breathe Webscale

As fast as things change in Silicon Valley, one constant over the years is the measurement for a young company’s success: momentum, profitability and a...

Was your black friday golden?

While most people were sleeping off their turkey-induced food comas and spending time with family and friends over the long weekend, Webscale’s support team...

Great user experiences start with fast content

I generally have zero tolerance for slow web page load times – I mean don’t we all? But regardless of how content-rich your website may be, there are some...

Why we’re spending $20M on the Mid-Market

I couldn’t be more thrilled to share the news that we have secured $12M in funding. This new investment validates our market opportunity and supports our...

A Second in the Life of a Web Request

Welcome back! When an end user out in the real world points their browser to your website, the next 1-3 seconds are crucial. According to research, 40% of...

Bringing simplicity and agility to web application owners

Welcome to the new Webscale blog. I'm Sonal Puri, CEO of Webscale, and I'm passionate about technology startups. In particular, I’m passionate about the...

Welcome to CTO Corner

Hi! I’m Jay, co-founder and CTO of Webscale---welcome to the CTO Corner. As someone that’s lived and breathed Webscale for the last four years, I’m pretty...

![[CASE STUDY] HOW EVENT NETWORK’S 100+ ONLINE STORES STAY UP AND SECURE THROUGH THE HOLIDAY SEASON AND BEYOND, WITH WEBSCALE](https://www.webscale.com/wp-content/uploads/2022/11/event-network.png)

![[Case Study] How Skate One Skated to Site Uptime, Performance, and Support Wins with Webscale](https://www.webscale.com/wp-content/uploads/2022/11/skate1-blog-banner.jpg)

![[Case Study] How Skinit Achieved 100% Uptime and Blazing Fast Performance with Webscale](https://www.webscale.com/wp-content/uploads/2022/11/skinit-blog-banner.jpg)

![[Case Study] How Dolls Kill Sustains 100% Uptime, Blazing Fast Performance, and Hyper-Growth with Webscale](https://www.webscale.com/wp-content/uploads/2022/11/dolls-kill-blog-banner.jpg)

![[Case Study] How HYLETE went from a Black Box to the World`s Most Scalable Hosting Infrastructure](https://www.webscale.com/wp-content/uploads/2022/11/hylete-blog-banner.jpg)